Welcome to the Zorba Q1 2024 SFR Off-Market Acquisitions report. In this analysis, we’re looking closely at the shifts in the Single Family Rental (SFR) market’s dynamics from Q4 2023 to Q1 2024, focusing on off-market acquisitions by institutional residential real estate owners.

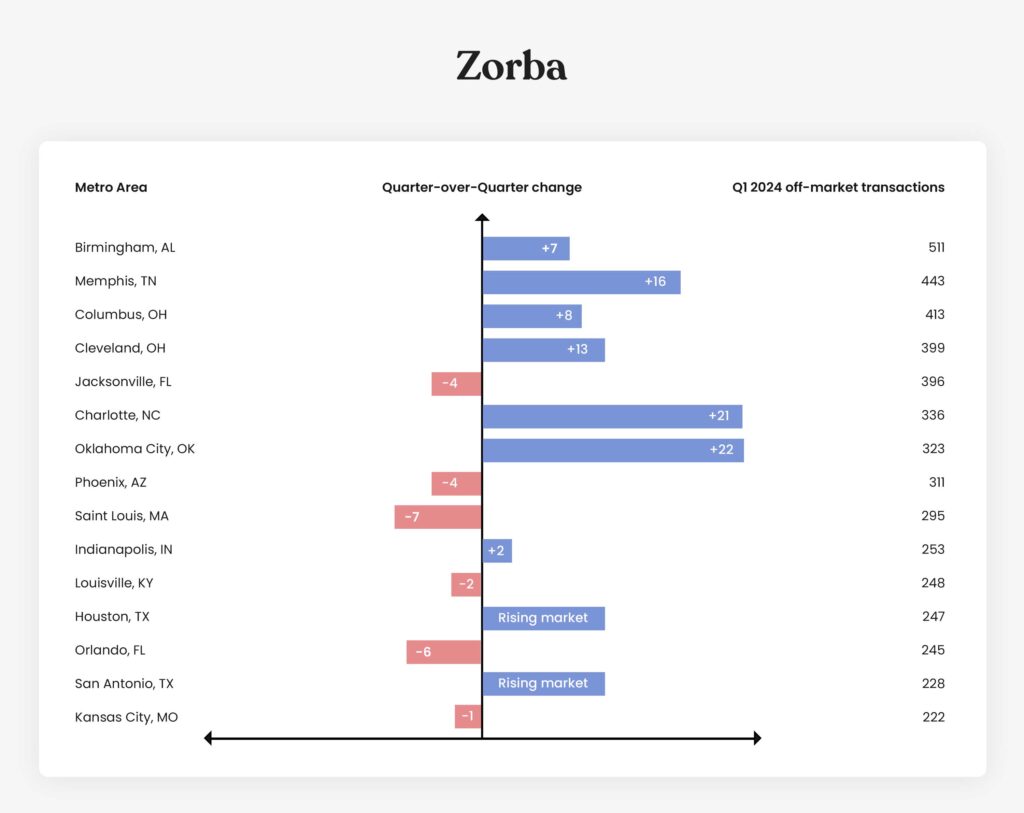

The top 15 MSAs by number of off-market transactions made by institutional owners:

Data overview

Zorba is dedicated to ensuring the accuracy and transparency of our data. We start with nationwide deed and assessor information from our real estate data provider Cherre, enriching it with proprietary data, including bid/ask ratios and market activity on the Zorba platform. For this analysis, we have:

- Identified institutional owners as LLCs or other organizational forms (excluding trusts) that have completed at least 20 cash purchases in the past 90 days with the intention to hold these properties.

- Distinguished between properties listed on the MLS and those acquired off-market.

- Reconciled the entities under which SFR owners purchase properties to monitor their activity.

Our approach corrects for the sample bias inherent in other private sources, producing results that are much closer to statistics published by the public records and HUD. Please note that the refresh rate might result in minor discrepancies in the data from the last two weeks of the quarter.

Birmingham Leads the Charge

Birmingham, AL has emerged as a major market for institutional SFR owners, climbing 7 levels up to the top of the list, recording 511 off-market transactions in Q1 2024. This surge is accompanied by a rent increase of 1.63% since the last quarter.

Memphis and Columbus: Emerging Investment Frontiers

Memphis, TN, and Columbus, OH have caught the attention of institutional owners with 443 and 413 off-market transactions, respectively, establishing themselves as markets to watch. Memphis has returned to the top 15 MSA list after being absent in the last quarter. Both cities have seen positive rent growth trends, with Memphis experiencing a 1.27% increase and Columbus a 1.18% rise.

Stronger returns for off-market acquisitions

Expected returns for off-market SFR purchases have risen by 13% compared to MLS listings from Q4 2023 to Q1 2024.

Zorba is an automation and data intelligence platform for acquisition and disposition teams in the Single Family Rental (SFR) and Build To Rent (BTR) sectors. We streamline the process of buying and selling off-market properties at scale.

Acquisition teams Discover how to leverage the Zorba platform to enhance returns for your fund while automating acquisition workflows.

Tech-enabled brokerages and Proptechs Learn how to utilize Zorba’s tech solutions to 10x efficiency and revenue.

Data Access

Zorba publishes monthly SFR & BTR acquisition reports and underlying data for hundreds of cities across the nation, as well as data aggregated for counties, metros, and states. These data are intended to be a source of reliable information that help acquisition teams, tech-enabled acquisition brokerages, Proptechs, and policymakers make sound decisions.

Stay tuned for our next quarterly update.